Agency Owners

Agency owners who use the product in their shop/agency and hire agents to operate the product within the shop/agency

- - Manage agents

- - Better reporting

- - Increase sales and have more services

Step inside a Lightric Motors vehicle and experience the perfect fusion of luxury and efficiency. Our interiors are meticulously crafted with premium materials and cutting-edge technology to create driving experience.

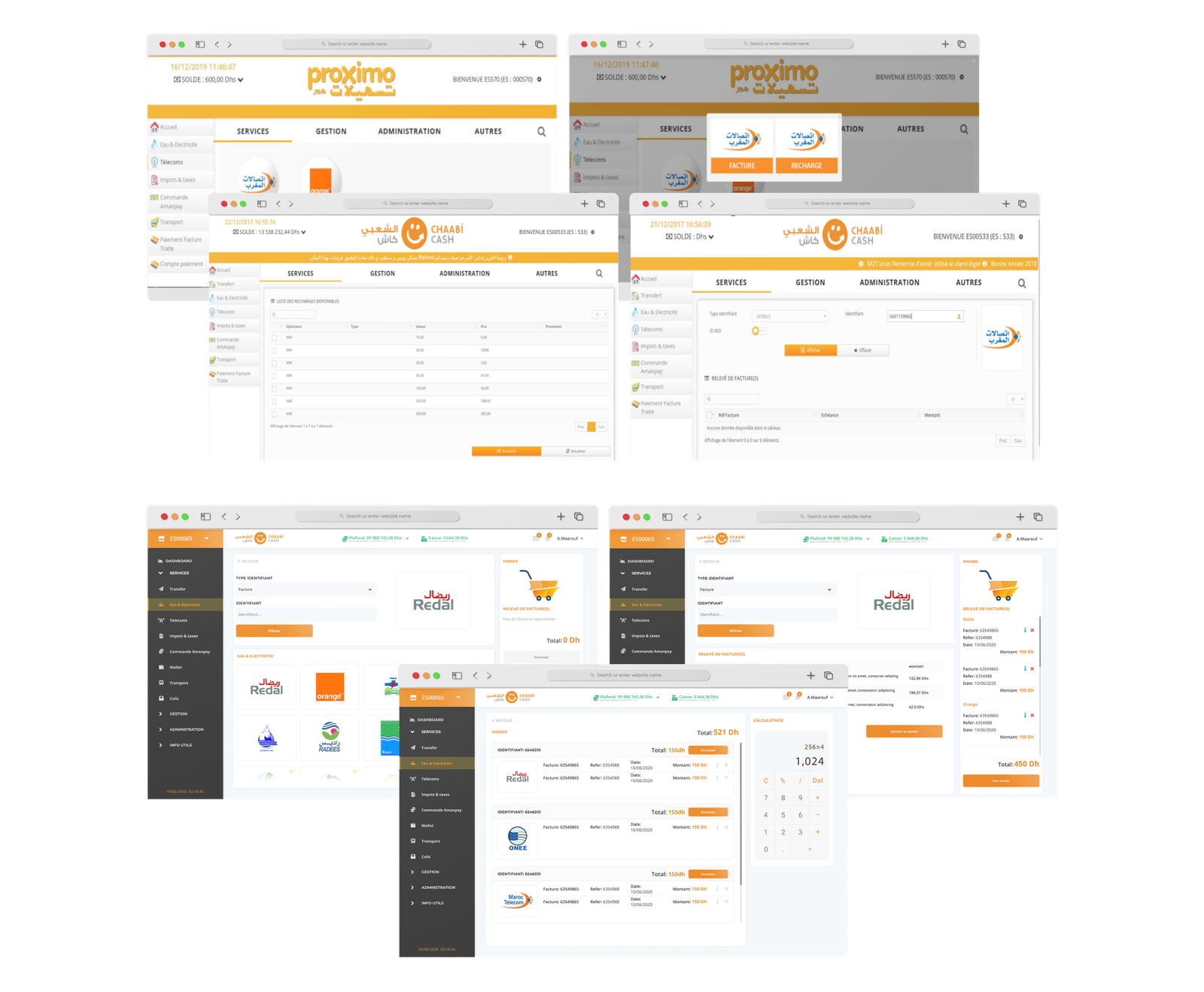

Given the competition and technology advancement, Maroc Traitement de Transactions (M2T) opted to make a new version of their existing web solution POS (point of sell) that is being used by +5k agencies & partners across the country. Along with these challenges, there are also other key factors and difficulties:

Instead of working on the existing solution, we opted to create a new one from scratch, that will enable us to solve and freely approach each problem and provide the end user with a robust product.

Agency owners who use the product in their shop/agency and hire agents to operate the product within the shop/agency

Agency agents (can also be Agency Owner) who use the product in order to provide proximity services to their clients, paying bills, money transfer, telecom services…

Clients who go to the shop/agency and do transactions, monthly payments…

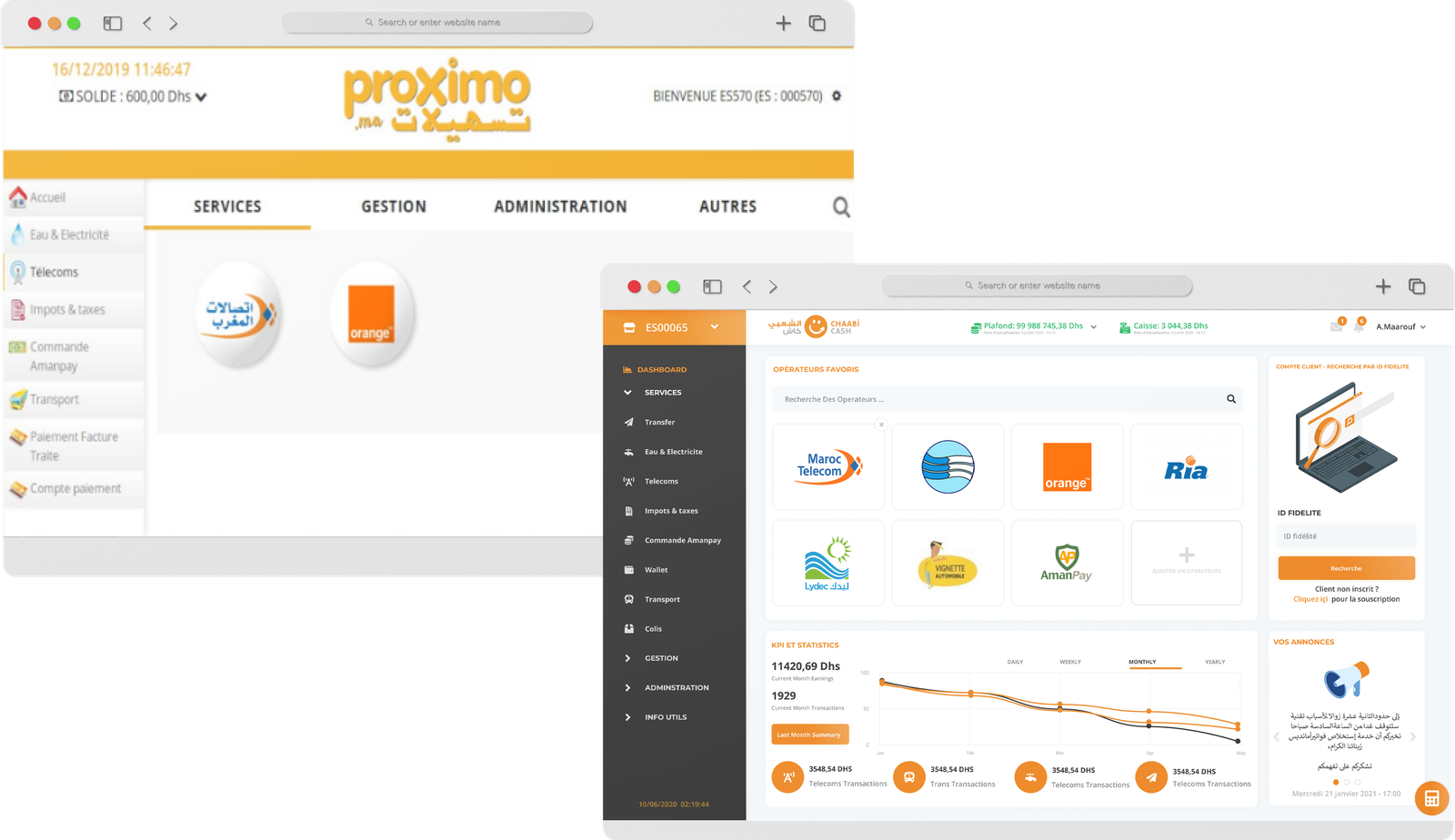

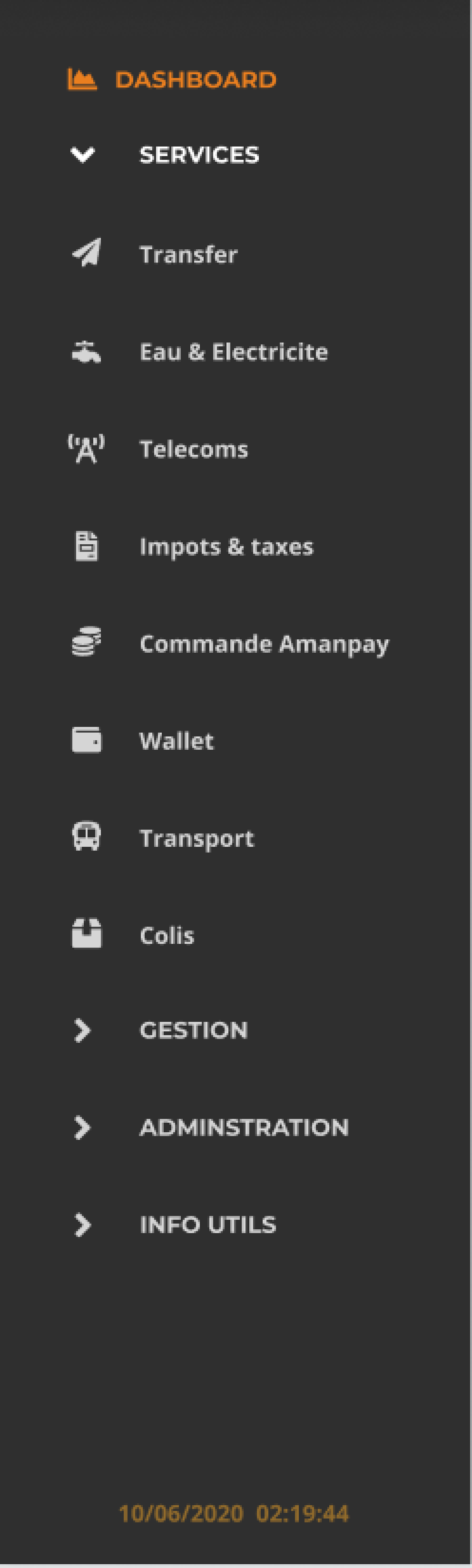

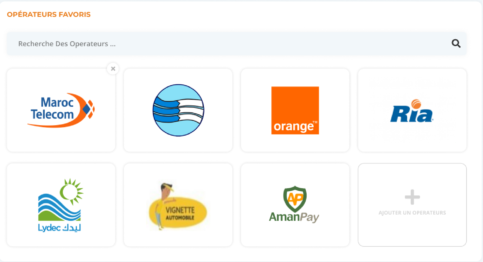

A modern dashboard with a new navigation, smart favorite section with search bar, fidelity section, kpis and stats section, advertising section

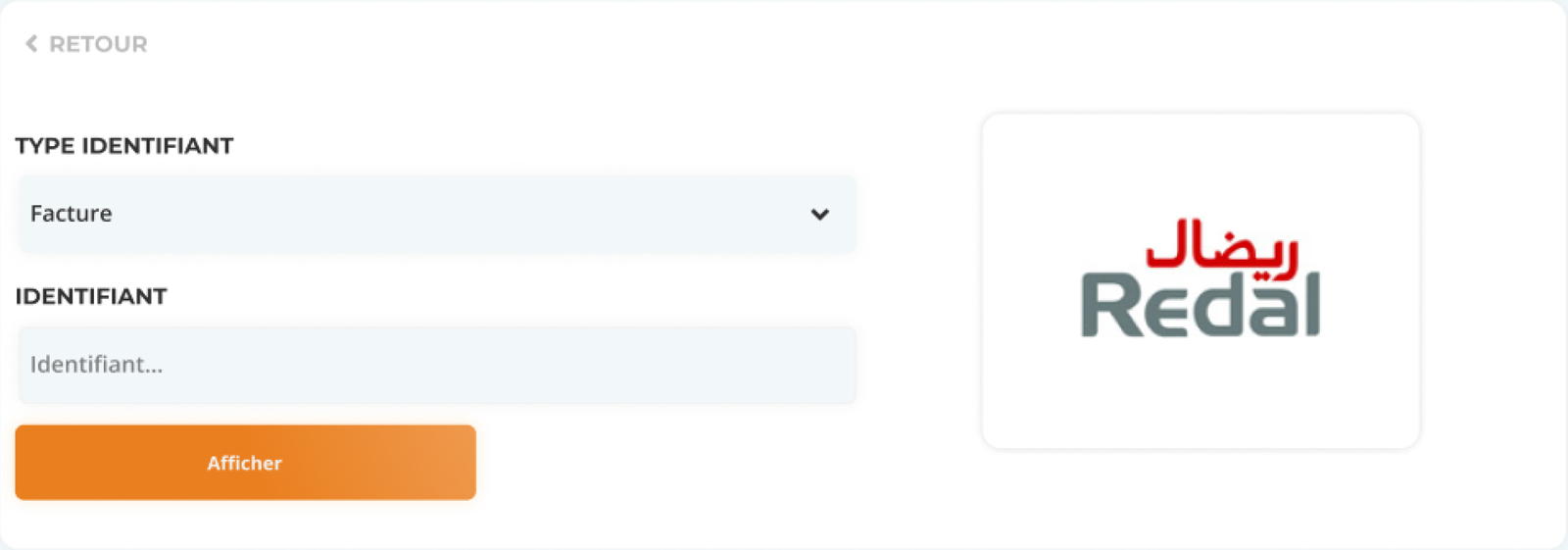

The bill payment process has been overhauled with a new, user-centric interface, featuring a structured layout that displays three main sections

Each service form is now accompanied by an image, clearly indicating to users which service they are interacting with.

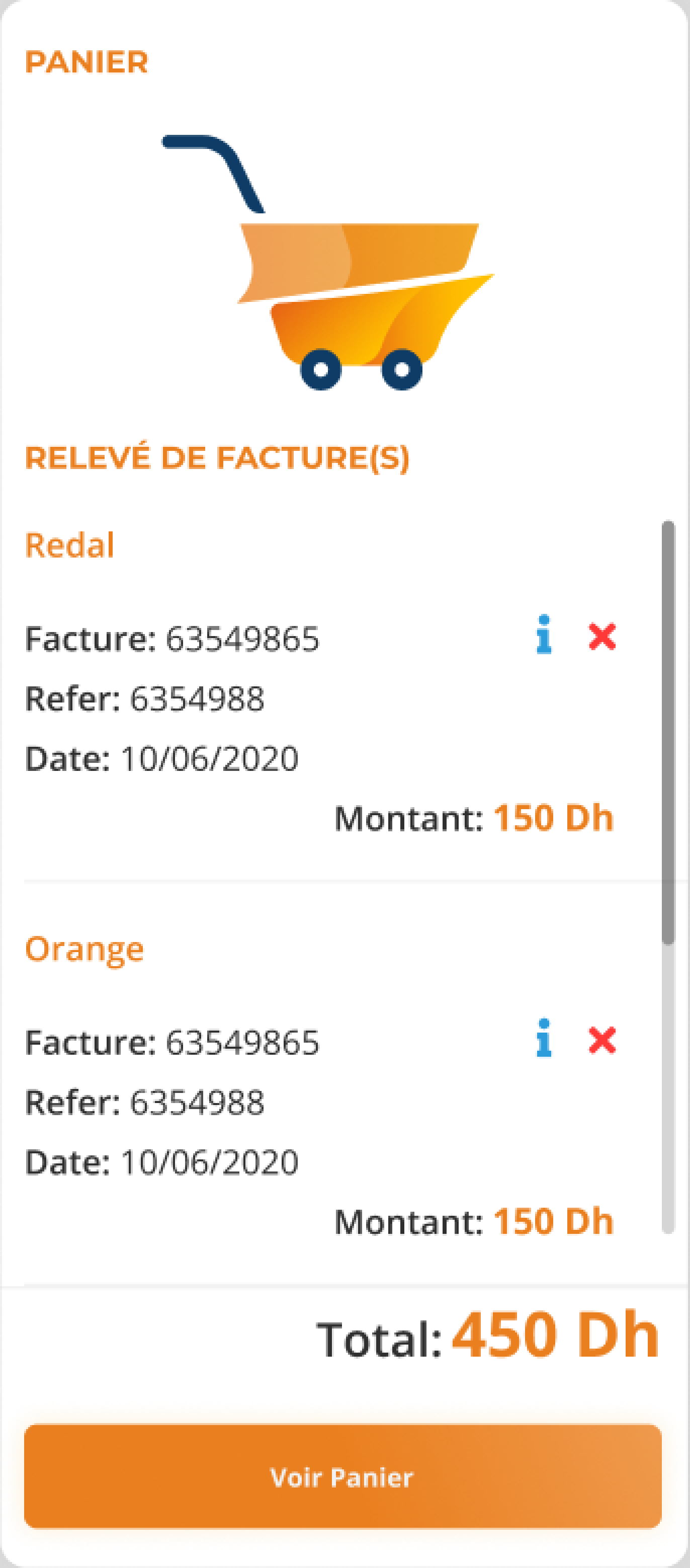

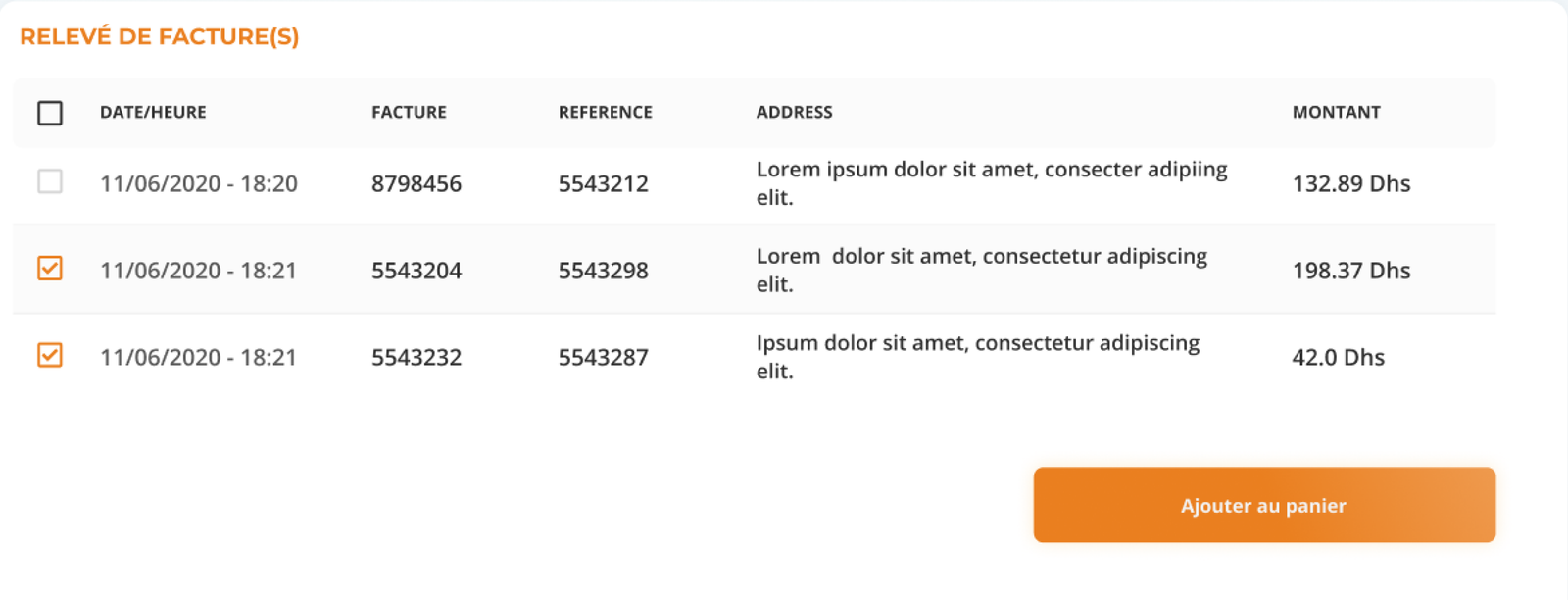

Based on agent feedback and a thorough user experience audit, we recognized the inefficiencies in the previous system. For instance, agents managing family bills—covering multiple phones and utilities—previously had to search, select, and checkout each bill individually. This process was time-consuming and repetitive. To streamline operations, we introduced a cart feature where agents can add multiple bills for the same client. This cart includes enhanced functionalities such as an information tooltip, the ability to delete items, a running total, and a simplified checkout page. Although limitations in service communication prevented the implementation of a bulk checkout feature, agents can now process all bills for the same service simultaneously on a single page.

This section dynamically displays related services to prevent errors and save time. If an agent selects the wrong service, they can easily switch without needing to navigate back, thus speeding up the transaction process.

Upon submission of a service form, this section transforms to show all available unpaid bills, allowing agents to quickly select and add bills to the cart. This feature is designed to facilitate faster and more efficient bill processing, enhancing overall user satisfaction.

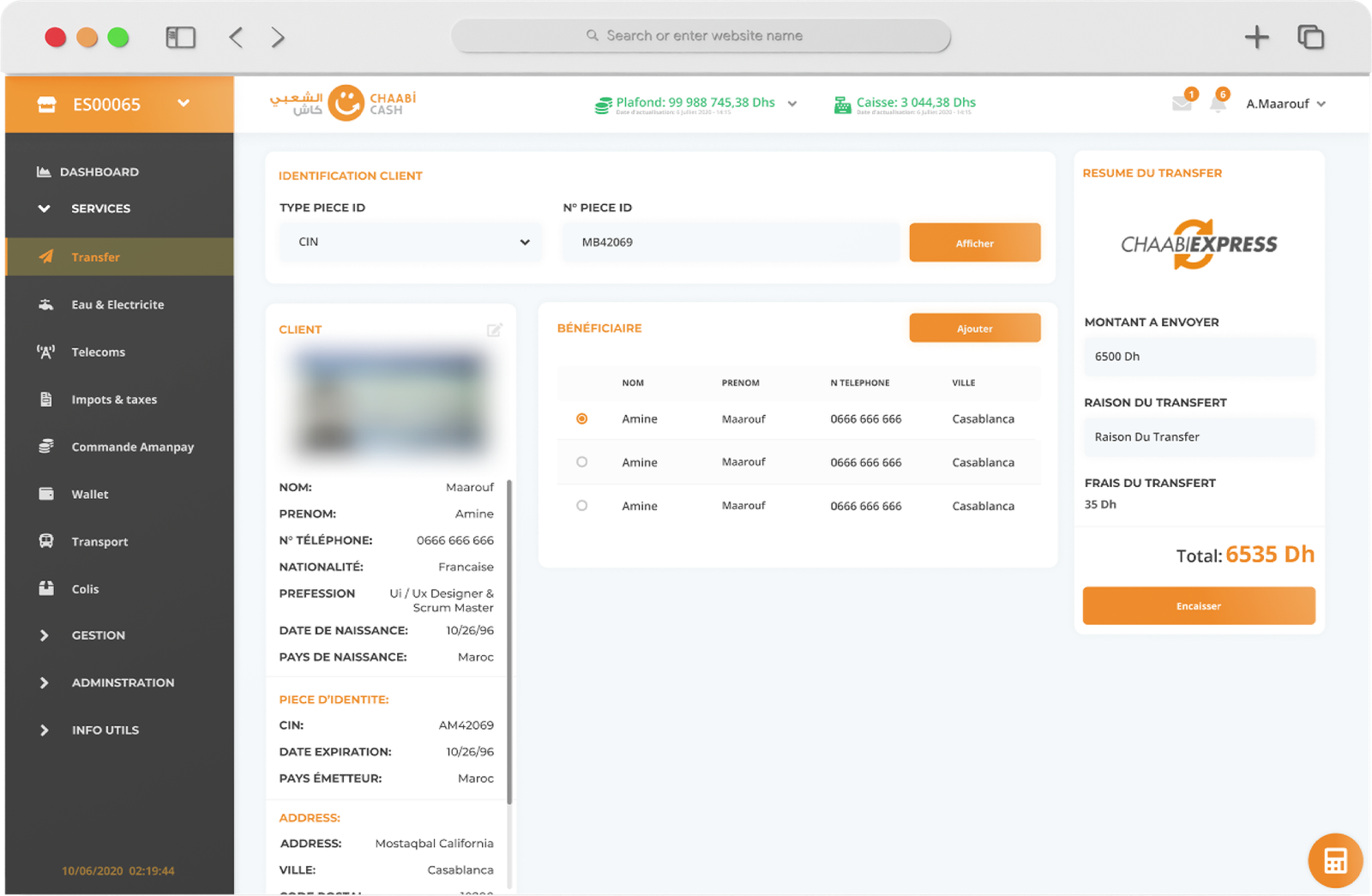

The money transfer process was a significant challenge within our platform. Traditionally, every transaction required clients to present identification, and agents had to navigate a lengthy and cumbersome form-filling process, collecting extensive details about both sender and recipient. This procedure was mandatory even for repeat clients, leading to inefficiencies and client dissatisfaction. To address these issues and harmonize the user experience across different services, we have implemented a more streamlined approach

Following the structured approach used in the bill payment system, the money transfer section now offers a more intuitive and error-proof interface. This redesign helps prevent the common issue of agents entering incorrect data to expedite the process, which previously led some clients to seek alternative services due to the cumbersome requirements.

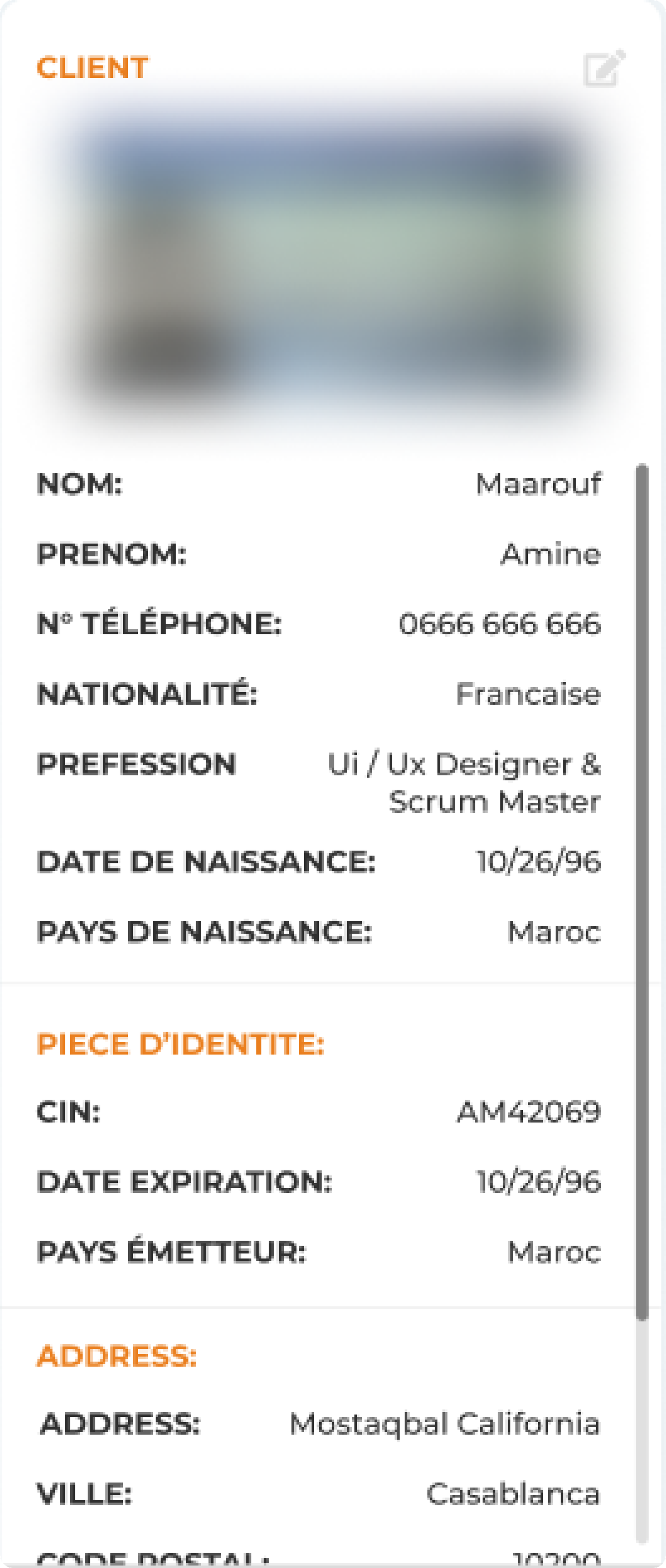

We now allow for the creation of client accounts where agents need to enter the client's information just once. For subsequent transactions, agents can quickly retrieve a client's details using their identification number, dramatically reducing the time and effort involved in setting up new transfers.

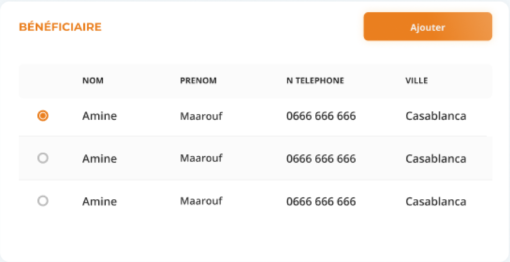

Agents can now save recipient details, enabling faster and more efficient future transactions. This feature is especially beneficial for repeat transfers, such as clients who regularly send money to family members.

These sections are part of a suite of tools that work together to create a cohesive and efficient experience for both the platform's users and administrators. Each component has been carefully developed to ensure it meets the needs of a diverse user base while maintaining the highest standards of security and functionality.

This refined process not only enhances efficiency but also improves overall client satisfaction by reducing the repetitive burden of information provision and waiting times.